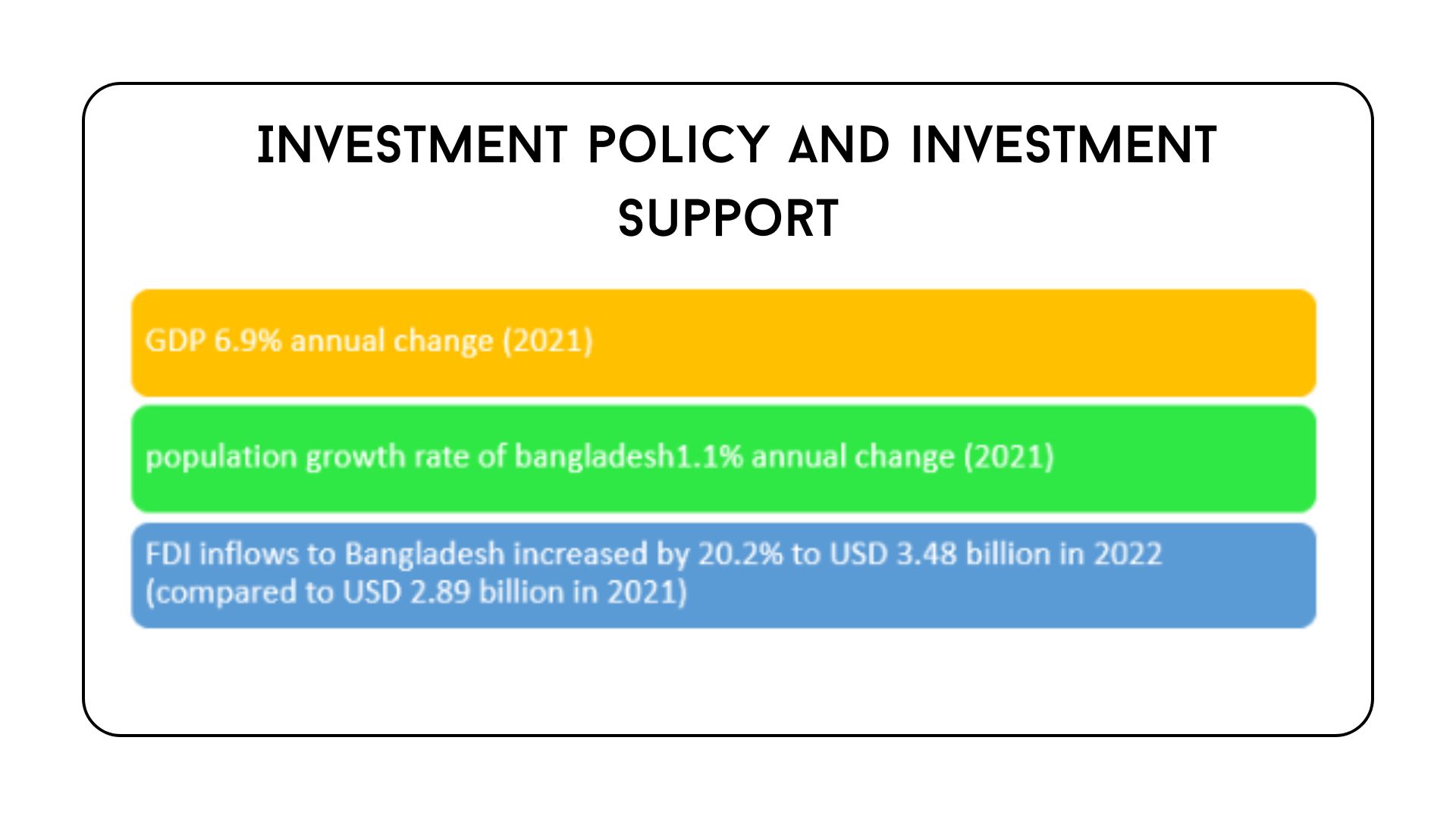

Bangladesh emerges as one of the fastest-growing economies globally, maintaining a

remarkable record of consistent GDP growth without any negative slumps over the last

three decades. With an impressive GDP growth rate exceeding 7% in the past decade,

Bangladesh stands out among emerging markets. This growth is supported by political

stability under a democratic system and effective monetary and fiscal management,

ensuring steady inflation rates. Moreover, the country boasts high connectivity, a

competitive market, a business-friendly environment, and a cost-effective structure,

offering lucrative returns for investors.

The Bangladeshi government prioritizes investment,

aiming to establish an open, predictable, and competitive climate to achieve development

goals. Energy prices in Bangladesh are highly competitive in the region, further

enhancing its attractiveness to investors. Legal protections for foreign investments

through acts like the Foreign Private Investment (Promotion and Protection) Act of 1980

safeguard against expropriation and provide for equitable treatment, exit strategies,

and capital repatriation.

Efforts to create a contemporary business climate

through comprehensive reforms across various spheres demonstrate Bangladesh's commitment

to fostering a conducive environment for business. The country's legal and policy

framework favours foreign investment, reflecting its warm attitude towards investors.

With a youthful workforce and potential in technical education, Bangladesh offers ample

opportunities for outsourcing and ICT sector growth, supported by tech parks across key

cities.

The country's robust consumer demand, fueled by a

population exceeding 160 million, drives growth across various sectors, including

consumer goods and fintech. Additionally, Bangladesh's strategic geographical position

as a gateway to the Asia-Pacific region facilitates access to large markets and offers

advantages in terms of low labour costs. Dhaka, the capital city and economic hub,

boasts well-developed communication infrastructure and serves as a vital centre for

trade and finance in Eastern South Asia.

Bangladesh's position in the global value chain as a

competitive supplier is reinforced by numerous bilateral and multilateral agreements,

including free trade agreements with the EU and other developed nations. The government

continues to offer incentives, tax exemptions, and policy reforms to encourage further

investment and address infrastructural deficiencies. Overall, the economic and

legislative environment in Bangladesh remains favourable for foreign investors,

presenting a compelling case for businesses seeking growth opportunities in the region.

Bangladesh has made significant strides in its development journey, poised to graduate

from least developed country (LDC) status within a decade. Industries such as mobile

telephony, power generation, and financial services have seen some limited impact from

FDI.

To address these challenges, the Investment Promotion and Protection Review (IPR)

recommends actions under two main pillars: enabling investment for sustainable

development through an improved regulatory framework and enhancing infrastructure for

sustainable development through FDI. The current investment law, while relatively open

to FDI, has limitations in scope and coverage, leaving room for restrictive sector-level

regulations. For instance, ownership restrictions and ministry approvals are required

for industries deemed "controlled," while high-growth sectors like ready-made garments

and pharmaceuticals face discouragement of FDI.

To attract more FDI and improve the investment climate, the IPR calls for the adoption

of a modern investment law and regulatory reforms addressing issues such as foreign

exchange regulations, corporate taxation, land access, skills development, and public

administration.

The strategic focus, at the government's request, is on attracting FDI

through public-private partnerships (PPPs) to upgrade critical infrastructure such as

electricity, roads, and ports. In the electricity sector, Bangladesh aims to increase

supply to address shortages and meet growing demand.

While some FDI has been attracted

through power purchase agreements, further government action is needed to encourage

larger inflows, including pricing reforms to reflect costs and promotion of renewable

energies.

Regarding road infrastructure, there are promising PPP

opportunities with a pipeline of priority highway projects.

Bangladesh emerges as one of the fastest-growing economies globally, maintaining a

remarkable record of consistent GDP growth without any negative slumps over the last

three decades. With an impressive GDP growth rate exceeding 7% in the past decade,

Bangladesh stands out among emerging markets. This growth is supported by political

stability under a democratic system and effective monetary and fiscal management,

ensuring steady inflation rates. Moreover, the country boasts high connectivity, a

competitive market, a business-friendly environment, and a cost-effective structure,

offering lucrative returns for investors.

Bangladesh emerges as one of the fastest-growing economies globally, maintaining a

remarkable record of consistent GDP growth without any negative slumps over the last

three decades. With an impressive GDP growth rate exceeding 7% in the past decade,

Bangladesh stands out among emerging markets. This growth is supported by political

stability under a democratic system and effective monetary and fiscal management,

ensuring steady inflation rates. Moreover, the country boasts high connectivity, a

competitive market, a business-friendly environment, and a cost-effective structure,

offering lucrative returns for investors.

The Bangladeshi government prioritizes investment,

aiming to establish an open, predictable, and competitive climate to achieve development

goals. Energy prices in Bangladesh are highly competitive in the region, further

enhancing its attractiveness to investors. Legal protections for foreign investments

through acts like the Foreign Private Investment (Promotion and Protection) Act of 1980

safeguard against expropriation and provide for equitable treatment, exit strategies,

and capital repatriation.

The Bangladeshi government prioritizes investment,

aiming to establish an open, predictable, and competitive climate to achieve development

goals. Energy prices in Bangladesh are highly competitive in the region, further

enhancing its attractiveness to investors. Legal protections for foreign investments

through acts like the Foreign Private Investment (Promotion and Protection) Act of 1980

safeguard against expropriation and provide for equitable treatment, exit strategies,

and capital repatriation.

Efforts to create a contemporary business climate

through comprehensive reforms across various spheres demonstrate Bangladesh's commitment

to fostering a conducive environment for business. The country's legal and policy

framework favours foreign investment, reflecting its warm attitude towards investors.

With a youthful workforce and potential in technical education, Bangladesh offers ample

opportunities for outsourcing and ICT sector growth, supported by tech parks across key

cities.

Efforts to create a contemporary business climate

through comprehensive reforms across various spheres demonstrate Bangladesh's commitment

to fostering a conducive environment for business. The country's legal and policy

framework favours foreign investment, reflecting its warm attitude towards investors.

With a youthful workforce and potential in technical education, Bangladesh offers ample

opportunities for outsourcing and ICT sector growth, supported by tech parks across key

cities.

The country's robust consumer demand, fueled by a

population exceeding 160 million, drives growth across various sectors, including

consumer goods and fintech. Additionally, Bangladesh's strategic geographical position

as a gateway to the Asia-Pacific region facilitates access to large markets and offers

advantages in terms of low labour costs. Dhaka, the capital city and economic hub,

boasts well-developed communication infrastructure and serves as a vital centre for

trade and finance in Eastern South Asia.

The country's robust consumer demand, fueled by a

population exceeding 160 million, drives growth across various sectors, including

consumer goods and fintech. Additionally, Bangladesh's strategic geographical position

as a gateway to the Asia-Pacific region facilitates access to large markets and offers

advantages in terms of low labour costs. Dhaka, the capital city and economic hub,

boasts well-developed communication infrastructure and serves as a vital centre for

trade and finance in Eastern South Asia.

Bangladesh's position in the global value chain as a

competitive supplier is reinforced by numerous bilateral and multilateral agreements,

including free trade agreements with the EU and other developed nations. The government

continues to offer incentives, tax exemptions, and policy reforms to encourage further

investment and address infrastructural deficiencies. Overall, the economic and

legislative environment in Bangladesh remains favourable for foreign investors,

presenting a compelling case for businesses seeking growth opportunities in the region.

Bangladesh's position in the global value chain as a

competitive supplier is reinforced by numerous bilateral and multilateral agreements,

including free trade agreements with the EU and other developed nations. The government

continues to offer incentives, tax exemptions, and policy reforms to encourage further

investment and address infrastructural deficiencies. Overall, the economic and

legislative environment in Bangladesh remains favourable for foreign investors,

presenting a compelling case for businesses seeking growth opportunities in the region.

Bangladesh has made significant strides in its development journey, poised to graduate

from least developed country (LDC) status within a decade. Industries such as mobile

telephony, power generation, and financial services have seen some limited impact from

FDI.

Bangladesh has made significant strides in its development journey, poised to graduate

from least developed country (LDC) status within a decade. Industries such as mobile

telephony, power generation, and financial services have seen some limited impact from

FDI.  To address these challenges, the Investment Promotion and Protection Review (IPR)

recommends actions under two main pillars: enabling investment for sustainable

development through an improved regulatory framework and enhancing infrastructure for

sustainable development through FDI. The current investment law, while relatively open

to FDI, has limitations in scope and coverage, leaving room for restrictive sector-level

regulations. For instance, ownership restrictions and ministry approvals are required

for industries deemed "controlled," while high-growth sectors like ready-made garments

and pharmaceuticals face discouragement of FDI.

To address these challenges, the Investment Promotion and Protection Review (IPR)

recommends actions under two main pillars: enabling investment for sustainable

development through an improved regulatory framework and enhancing infrastructure for

sustainable development through FDI. The current investment law, while relatively open

to FDI, has limitations in scope and coverage, leaving room for restrictive sector-level

regulations. For instance, ownership restrictions and ministry approvals are required

for industries deemed "controlled," while high-growth sectors like ready-made garments

and pharmaceuticals face discouragement of FDI.

To attract more FDI and improve the investment climate, the IPR calls for the adoption

of a modern investment law and regulatory reforms addressing issues such as foreign

exchange regulations, corporate taxation, land access, skills development, and public

administration.

To attract more FDI and improve the investment climate, the IPR calls for the adoption

of a modern investment law and regulatory reforms addressing issues such as foreign

exchange regulations, corporate taxation, land access, skills development, and public

administration. The strategic focus, at the government's request, is on attracting FDI

through public-private partnerships (PPPs) to upgrade critical infrastructure such as

electricity, roads, and ports. In the electricity sector, Bangladesh aims to increase

supply to address shortages and meet growing demand.

The strategic focus, at the government's request, is on attracting FDI

through public-private partnerships (PPPs) to upgrade critical infrastructure such as

electricity, roads, and ports. In the electricity sector, Bangladesh aims to increase

supply to address shortages and meet growing demand.  While some FDI has been attracted

through power purchase agreements, further government action is needed to encourage

larger inflows, including pricing reforms to reflect costs and promotion of renewable

energies.

Regarding road infrastructure, there are promising PPP

opportunities with a pipeline of priority highway projects.

While some FDI has been attracted

through power purchase agreements, further government action is needed to encourage

larger inflows, including pricing reforms to reflect costs and promotion of renewable

energies.

Regarding road infrastructure, there are promising PPP

opportunities with a pipeline of priority highway projects.